what is fit on a pay stub

FIT on a pay stub stands for federal income tax. The pay stub explains the specifics of an employees compensation each pay period when they get their paychecks from you.

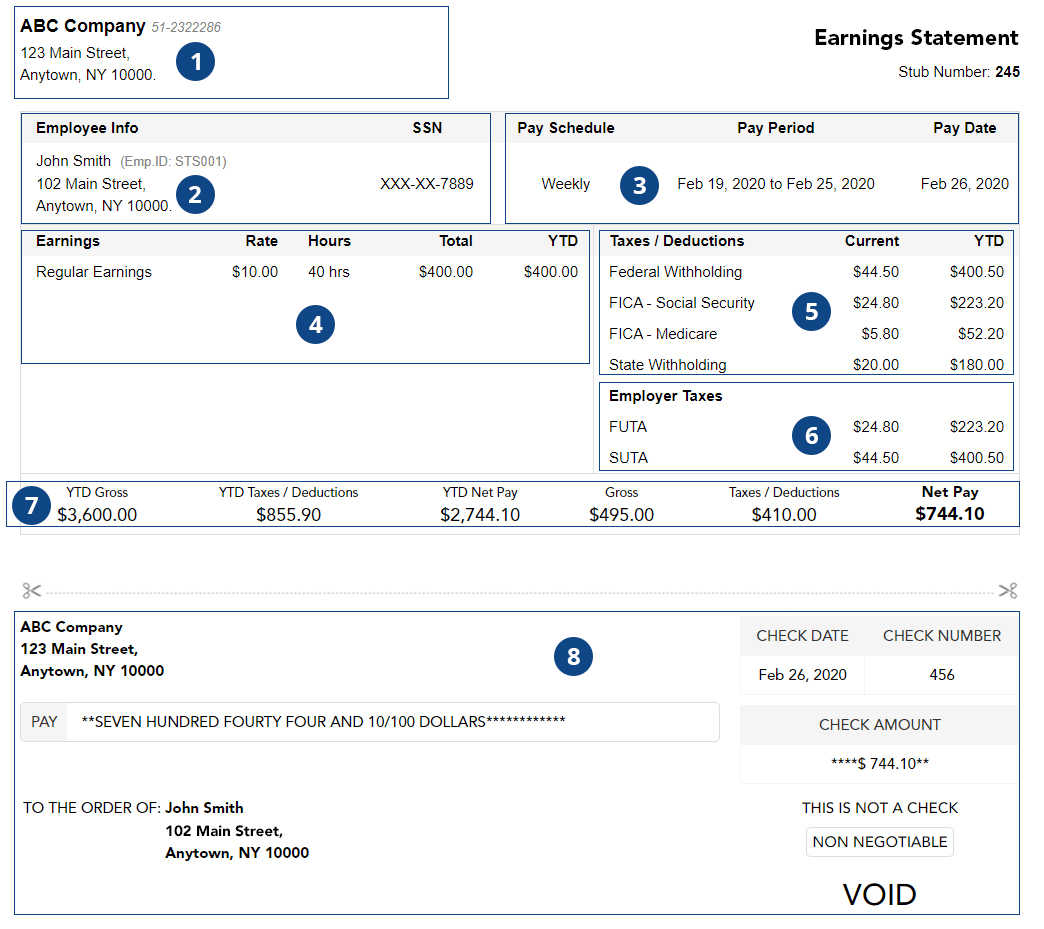

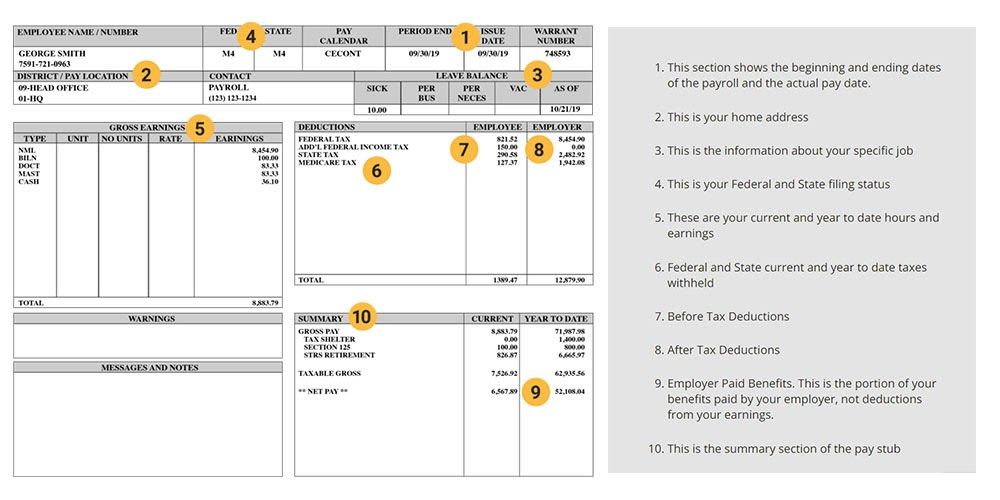

A Construction Paycheck Explained Example Pay Stub

FICA means Federal Insurance Contribution Act.

. Even if you dont live in a jurisdiction that mandates pay stubs the Fair Labor Standards Act. The paycheck and the pay stub are two different things. These items go on your income tax return as payments against your income tax liability.

Employee and Employer Information. More than likely this will include names and addresses only though some may also have phone numbers. FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return.

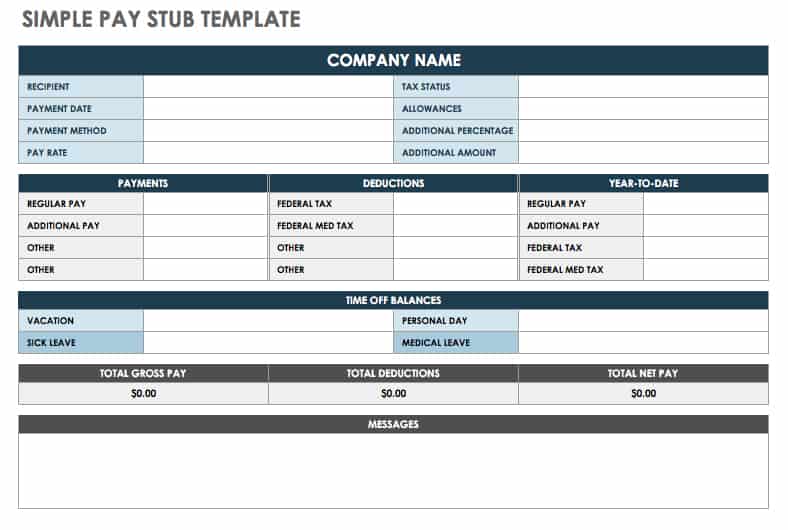

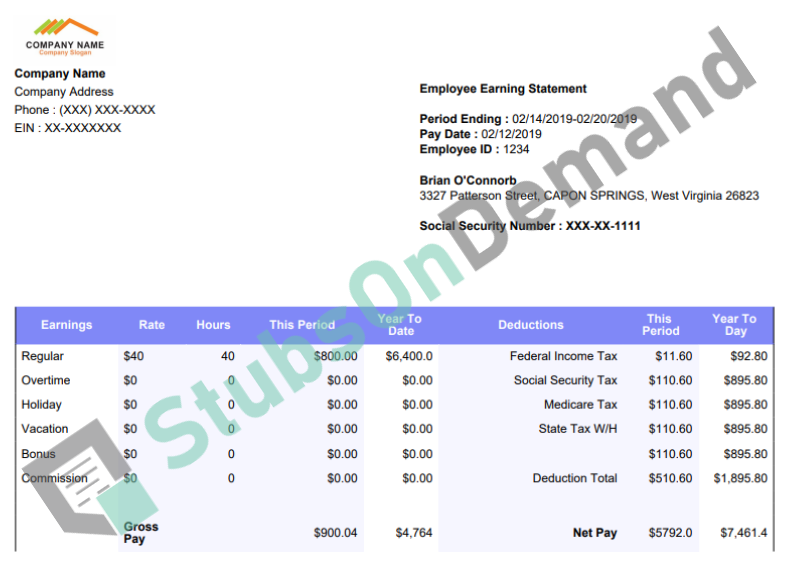

A pay stub also known as a paycheck stub or pay slip is the document that itemizes how much employees are paid. Ad In a few easy steps you can create your own paystubs and have them sent to your email. FIT Fed Income Tax SIT State Income Tax.

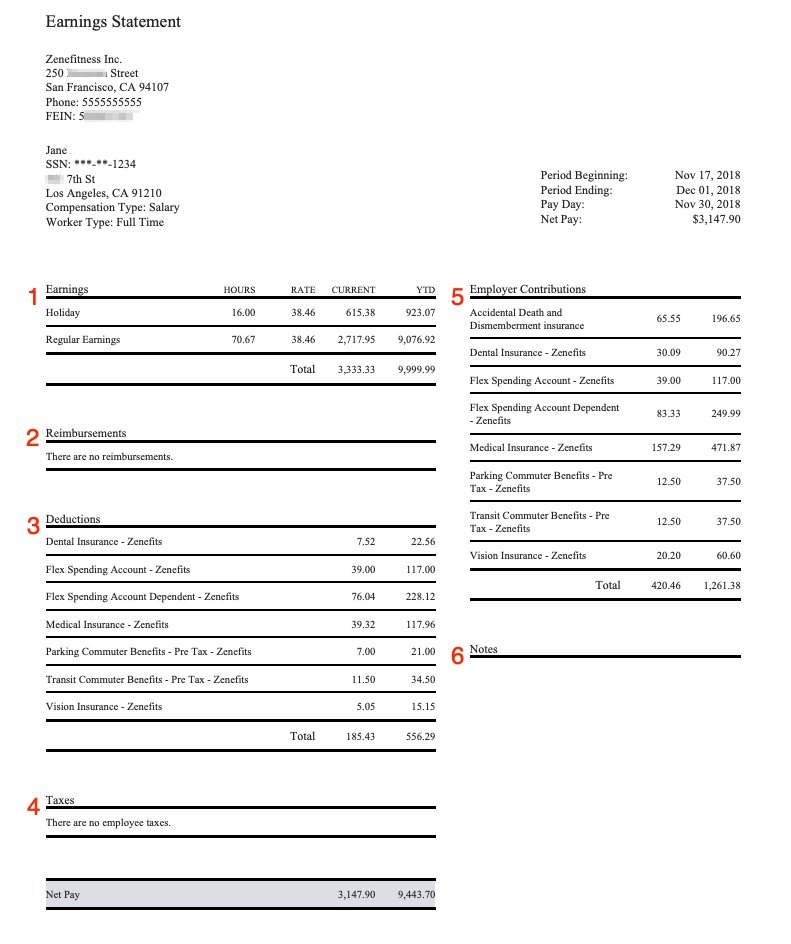

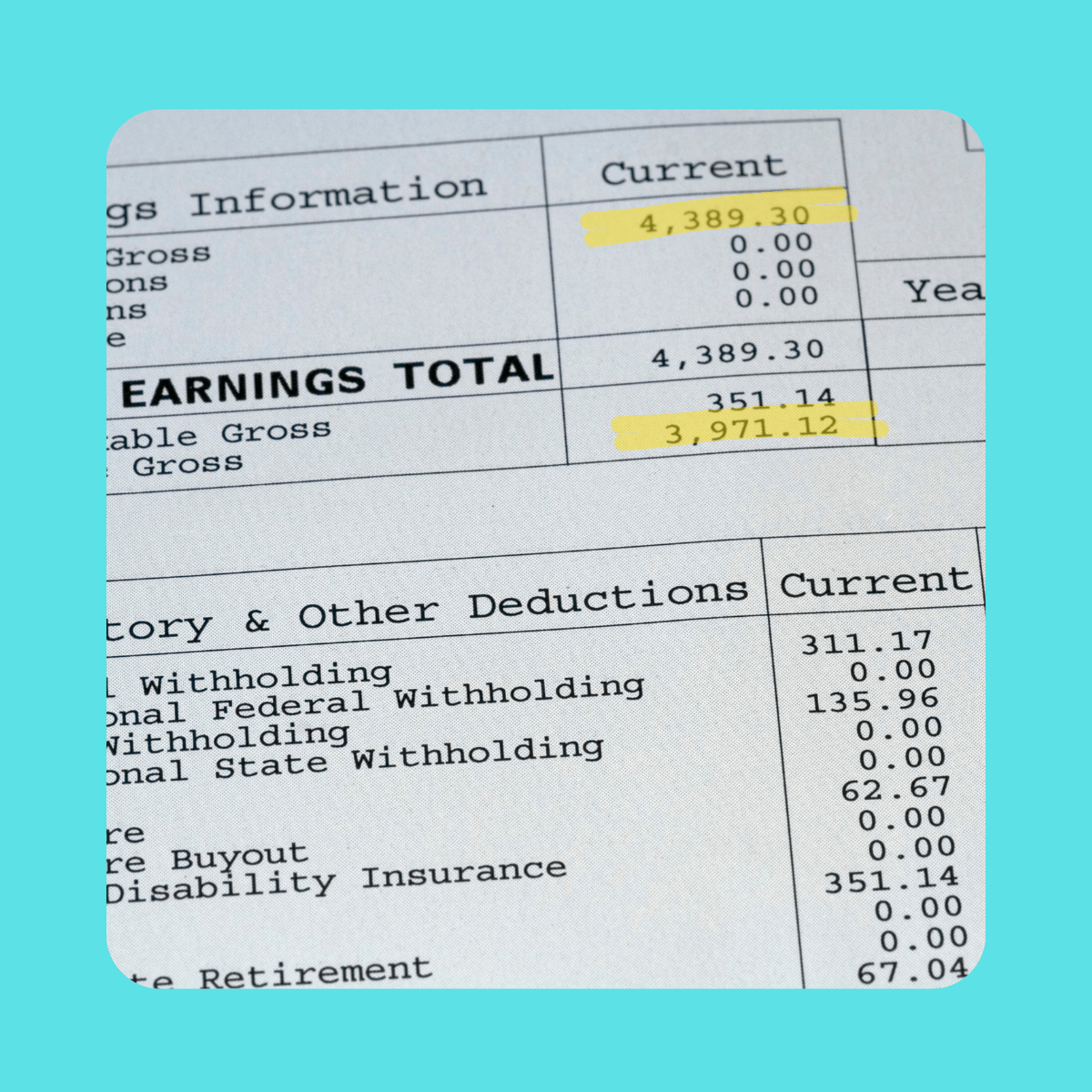

It contains vital information about how youre paid how much work youve done and how much youve paid in taxes and other deductions. A typical pay stub or bank statement. A pay stub may be created as a separate part of a paper paycheck or it may exist in electronic form.

Pay Stub Abbreviations are the abbreviations that you come across on any pay stub. Medicare covers medical related costs when you are old and gray. The first thing youll find on your paystub is information about you as the employee and your employer.

FIT is applied to taxpayers for all of their taxable income during the year. This pay stub definition fits what is referred to as a payslip. If you are wondering what is FIT on my paycheck it is essentially an amount of money that is withheld from your pay or salary to pay towards your federal income tax.

Payroll companies abbreviate the information that is printed on your pay stub to reduce it and make it easier for them to fit a lot of information on a single sheet of paper. Some payroll companies use their own set of these abbreviations while some dont. You will receive a pay stub for each pay period.

The pay stub includes complete information about deductions gross wages net pay etc. You may find valuable information about what taxes you pay deductions and other data on the pay stub. FITW is an abbreviation for federal income tax withholding Youll sometimes see it on payroll stubs to identify your withholding deductions.

Generate your paystubs online in a few steps and have them emailed to you right away. What does sit mean on your pay stub. FIT deductions are typically one of the largest deductions on an earnings statement.

While federal law does not force companies to give employees a pay stub some states have legislation requiring some type of documented pay statement. Employers generally must withhold these taxes from employees paychecks. FIT stands for federal income tax.

1 medicare and 2 social security. Save Time with Our Amazing Template. Fit is applied to taxpayers for all of their taxable income during the year.

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. FICA SS This refers to the Federal Insurance Contributions Act Social Security that you contribute mandatory Social Security payments to. It shows your total earnings for the pay period deductions from the total and your net pay after all those deductions.

A pay stub is a legal document that acts as your proof of earnings and employment. It includes employee details such as their name the pay periodapplicable dates of payment payroll number gross income net income tax deductions other contributions tax code and other relevant details. FIT means federal income taxes.

The rate is not the same for every taxpayer. They go toward costs needed to run the federal government. The federal government receiving the FIT taxes will typically use the funds to finance various federal programs and fund various sectors like education transportation energy and other areas.

They are all different taxes withheld. Some states also have an income tax of. Complete Your ADP Pay Stub Easily.

Some are income tax withholding. Thats the main difference. It covers two types of costs when you get to a retirement age.

How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn. Other groups such as charitable organizations can apply for tax-exempt status. Ad Fast Easy Secure.

The Federal Insurance Contributions Act regulates Social Security and Medicare taxes. Withholding is one way of paying income taxes to the. Some entities such as corporations and trusts are able to modify their rate through deductions and credits.

Key Takeaways A pay stub or paycheck stub includes. Your Social Security and Medicare withholding often show on your pay stub as FICA. A pay stub is any document that outlines payroll information about a particular employee.

You simply need to pick the one that best suits your needs. You can cash out your paycheck but you cant do that to a pay stub.

What Does A Pay Stub Look Like Workest

Let S Understand Your Checkstub Oer Commons

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

What Is A Pay Stub And How Practical It Is For Your Business

What Is A Pay Stub Loans Canada

A Guide On How To Read Your Pay Stub Accupay Systems

How To Do Payroll In Excel In 7 Steps Free Template Payroll Template Payroll Payroll Checks

Free Pay Stub Templates Smartsheet

Paystub Excel Template The Spreadsheet Page

What Does Pay Stub Pay Check Stub Salary Slip Or Payslip Mean

How To Get A Pay Stub From Direct Deposit By Stubs On Demand Medium

Create Pay Stubs Regular Pay Stub Professional Check Stubs Stubcheck Payroll Template Online Checks Paying

Free Pay Stub Templates Smartsheet